BoI: How Customer Analytics can Support Financial Well-Being

In attendance at MoneyLIVE Summit 2024, the Bank of Ireland’s (BOI’s) Head of Behavioural Insights, Jamie Renehan, discuses how customer analytics is supporting the financial well-being of customers amid tough economic times.

Analytics today is helping banking customers understand their finances better, delivering improved user experiences.

BoI: Understanding customers digitally

“If we go back to a pre-digital age, the bank manager in your branch would be the one to know your situation. So effectively, what we as banks are trying to do these days is to understand that in a digital context,” says Renehan.

Of course, as banks have increased their data footprints, the capabilities to engage customers on a personal level in the digital space have gotten easier.

But as banks continue to push into the digital space, what can they do to keep a human touch?

“There's an awful lot we can do in terms of financial well-being,” notes Renehan.

“We can have an understanding of where a customer is in relation to others in a similar scenario. For example, the journey of those first-time buyers in Ireland who are looking to purchase homes.

“Data can help us understand when a customer is going on that journey, and help us understand their needs for that particular property investment or purchase.”

Leveraging this understanding is also helping customers understand their own money better too, particularly in today’s cost-of-living crisis.

“Interest rates have been high for a period of time and so has the cost of living,” notes Renehan.

“Now we’re really starting to see the impact of living costs impact consumers, it is becoming more real for many. We see that discretionary spending, such as deliveries, and restaurant spending fluctuates quite a lot, depending on certain scenarios and the time of year.

“It’s clear people are looking to cut back, and analytics can really help banks deliver consumers insights into their expenditures.”

Finding answers in the space between people and data

Indeed, while good data can help provide insights into consumer spending behaviour, quantifying this alongside how humans interact and how they spend is of vital importance to Renehan.

“On the behavioural side of things, we have the cold information and data that allows us to make consumers calculations,” he says. “But the way that we behave as humans and interact with communities is important to understand. And if we can marry local, community understanding with data, that can be a really powerful thing.

“An example could be an elderly shopper, who is very unlikely to change their shopping habits, or deviate from shopping at their local supermarket,” Renehan says.

“Other shoppers might be a bit sporadic, particularly younger generations, but that’s ok, that is just a different type of habit. As a bank, it’s about understanding those habits to deliver the best solutions to your clients.”

**************

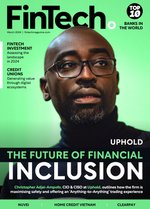

Make sure you check out the latest edition of FinTech Magazine and also sign up to our global conference series – FinTech LIVE 2024.

**************

FinTech Magazine is a BizClik brand.