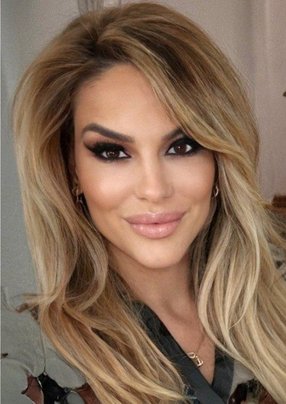

Maja Mikic

Executive Director for Digital Transformation at BRD

Graduating in Theoretical Maths before gaining her master’s degree in Financial Engineering, Maja Mikic is the Executive Director for Digital Transformation at BRD Groupe Société Générale.

Mikic who started her career in IT as an Information Technology Developer, has since risen up through the company to where she is today. Mikic is a highly qualified and accomplished professional in the finance industry and a visionary leader in the field of digital transformation.

“One of the options after graduation was to work in the IT department of a bank on changing the central banking system, where the need for young engineers was quite high. I then pursued a job in finance because financial pirating was really important during those years; we’re talking about 2008/2009, and the profitability steering started to be very quantitative.”

Mikic's early career primarily centred around her mathematical expertise in the banking sector. Her role involved assessing profitability, cost distribution, fund transfer pricing, and similar financial aspects. Over time, this role evolved to align with the ever-changing financial landscape, adapting to shifts and crises in Central Eastern Europe.

While the 2008 financial crisis did not have an immediate impact on Mikic's region, its repercussions were delayed and surfaced around 2012. It was during this period that credit risk issues became notably prominent. Mikic found herself involved in missions that required her to travel from one country to another, with a focus on improving and managing asset quality. Her journey took her through various countries in the region, including the Czech Republic, Bulgaria, and Moldova, before ultimately settling in Romania.

“About eight years ago, the word ‘crisis’ had redefined the meaning when it came to the credit risk,” Mikic explains. “When this was resolved and the risk management job became quite boring, they moved me to digital transformation because the bank hadn’t invested a lot of time in the resources to follow the digitalisation trends.

“So, in the last three years, I've been in charge of all projects which have the main goal of digitising the banking offer, bank on distance, remote banking, digital banking, and all the digital safe channels. But also, the downsizing of the physical distribution network, meaning the branches and digitalising processes within them, in order to downsize and optimise the operating expense.”

Today, Mikic oversees a team of more than 200 members, coordinating agile delivery teams to drive innovation and bring about transformation of the organisation. Her responsibilities include building mobile and desktop web banking applications, managing the migration of over one million customers to a new platform, creating CRM solutions, implementing credit factory processes, and overseeing retail projects.

Mikic also handles online lending and onboarding platform implementation, maintains strong relationships with retail branches, optimises processes, and manages digitalisation initiatives. Additionally, Mikic is responsible for budgeting, approvals, and regulatory relationships.

Over the years and under Mikic’s leadership, BRD has utilised customer profiles to predict client behaviour and allow BRD to work towards fulfilling its overall vision of ‘operating as a customer-centric, universal model’, by offering the highest level of customer service, while simultaneously complementing the company’s digital banking efforts.

Read the full story HERE.

Make sure you check out the latest edition of FinTech Magazine and also sign up to our global conference series - FinTech LIVE 2024

**************

FinTech Magazine is a BizClik brand

Featured Interviews

"Everyone wants to ensure we succeed in delivering to clients in a way that focuses on a brighter future"