What can we expect from the Apple Pay Later rollout?

Klarna paved the way for buy-now-pay-later (BNPL) and now, around the world, we have plenty of choices from PayPal Credit to the newly launched Apple Pay Later. In fact, almost daily, we’re seeing the emergence of new BNPL service providers offering both B2C and B2B services. This is to meet the increase in demand for this popular purchase method.

A third of British consumers (33%) say they are likely to remove items at an online checkout if a BNPL option isn't offered – according to a recent Ecommpay survey. Meanwhile, the Centre for Financial Capability, a financial charity, found BNPL demand has soared among all age groups in the UK in the face of the cost-of-living crisis.

So, with demand for BNPL on the rise, it was only a matter of time before Apple entered this market segment.

What is Apple Pay Later?

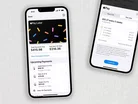

Apple Pay Later has been launched initially in the US, with select users invited to access a pre-release version. Those users can track, manage, and repay their four-payment, six-week loans through the Apple Wallet. While only select American users currently have access to this pre-release, the company has plans to offer Pay Later to all eligible users around the world in the coming months.

Despite the similarities of their BNPL offerings, Apple and PayPal have both chosen to fight for individual users within their offerings. This puts under the microscope why a particular buyer might choos one payment method over the other. Our research has shown that, now new BNPL regulations have been introduced to better protect consumers in the UK – with more on the way – 37% are more encouraged to use the payment option. So the question is, who will win the most consumer loyalty in 2023?

Read more: Pay Later – does Apple's latest offering threaten BNPL?

The scoring systems of each company, including their complexity and accessibility for the average consumer, will play an important role in user acquisition over the coming years. According to Statista, Apple Pay is set to generate $4bn in revenue in 2023, a vast increase from the less-than-$1bn it produced in 2019, and we can expect the rollout of the Pay Later offering to account for a chunk of this spending. For comparison's sake, PayPal – which has its own Pay in 4 and Pay in 3 options – registered total sales of $27.5bn last year. However, the same Statista source noted that the number of Apple Pay users is twice that of PayPal (68% vs 34%).

As Apple’s initial loan limit is also similar to PayPal’s, they’ll be in direct competition targeting a similar segment of the market, leaving the biggest purchases (up to $25,000) to the likes of Affirm. However, PayPal doesn’t seem to mind, favouring user choice by adding Apple Pay Later to its checkout options, alongside its own BNPL credit offering.

Additionally, unlike Klarna, which introduced late payment fees for the first time this year, this BNPL launch from Apple includes a 0% interest rate, which means it may begin to take some of the fintech giant’s market share when it launches across Europe in the coming months.

Is Apple Pay Later ethical?

When pursuing new users, it is necessary to remember the moral side of the BNPL issue. With a quarter of consumers in the UK saying they are more likely to use BNPL for purchases in 2023, compared to 2022 spending habits (25%), it’s important that those shoppers are protected.

We can expect to see more from Apple’s marketing team in the coming months on their latest offering, especially as the rollout is expanded around the world. They will be expected to account for the mounting pressure on the industry to promote responsible lending and borrowing by communicating the benefits and the risks with users, being transparent about fees, protecting privacy, and sharing payment history with credit agencies. After all, the data shows, 58% of British consumers feel that BNPL encourages them to spend more than they can afford, so the way lenders approach this conversation must change.

We at Ecommpay pay great attention not only to scoring the buyer’s risk but also the merchant’s. We always ensure that the companies we partner with sufficiently explain to their customers not only the benefits of BNPL, but also the risks. We believe that it is the responsibility of a trusted lender to provide a clear message within their payment flow to help the consumer fully understand what they're doing.

About the author

Olga Karablina is Head of Payment Product Development and Partner Relations at Ecommpay, a leading international payments service provider and UK and European card acquirer. Olga leads product development and spearheads the introduction of new payment options for the ecommerce, travel and fintech sectors, as well as continually innovating and enhancing Ecommpay’s product suite.

- How Klarna is Expanding BNPL with eBay in European PushFinancial Services (FinServ)

- How Klarna's AI Revolution Saves Millions AnnuallyFinancial Services (FinServ)

- How Klarna's IPO Bid Marks Shift From Private FundingDigital Payments

- Why Leading BNPL Fintech Affirm has Staked UK ClaimFinancial Services (FinServ)