Global PayEX optimises working capital via AR/AP automation

As the industry presses ahead with digitisation, there are dark corners of the finance world that risk being left behind. Without doubt, B2B finance processes have been overlooked in favour of digitisation in the B2C space. Now a raft of innovators are beginning to recognise the potential for greater disruption in B2B payments and related processes, and one of the most neglected areas is that of accounts receivable (AR) and accounts payable (AP).

Global PayEX offers a SaaS platform which helps businesses to automate and digitise AR and AP processes. The company wants to make B2B payments as seamless as paying a utility bill (C2B payment), and has designed digital customer journeys, including on mobile, that remove frictions in B2B payments. Based in Connecticut, US, the company is five years old – meaning no legacy tech hangover – and the firm already has a marquee customer base such as 3M, Bridgestone, Stanley Black and Decker, Reiter, Hafele and several other mid to large corporates. It has enabled its customers to realise significant operational efficiencies within their AR and AP departments and processes.

Implementing Global PayEX’s platform can reduce the number of days sales are outstanding (DSO) – the single biggest metric in AR. It can also speed up the time taken to reconcile a payment, and to automate the accounting into the ERP/accounting systems, which in turn can shorten the overall payment and reconciliation cycle and allow customers to place their next order sooner.

“That becomes a very powerful revenue acceleration for our clients, and also enhances customer satisfaction for our clients’ customers,” Chief Revenue Officer Naru Ramamoorthy explains. When Global PayEX’s platforms are fully implemented and integrated into a business, it can save them between 1% and 4% of their annual revenue.

Naru joined MphasiS at an early stage in 1999 and worked closely with MphasiS’ founders – Mohan Krishnan (Global PayEX’s CEO and Founder) and Jerry Rao and Jeroen Tas (Initial Global PayEX investors). MphasiS went on to become a multi-billion-dollar firm and was acquired by EDS and later by HP. He has more than 20 years’ experience in working with a full spectrum of B2B transformation and payments companies. In Global PayEX, Naru is responsible for global growth, both in existing and new markets.

“That's what I specialise in,” Naru says. “Essentially taking concepts which are semi-proven with an initial customer base and just multiplying it by 100, by 1,000. That's what I love doing, so that's why I came to Global PayEX.”

Solving unique challenges across both AR and AP

The company’s platform can be thought of as two separate ‘halves’, one for AR and one for AP. It plugs into a company’s ERP (that integration is the only part where custom code is required) meaning the interface can be customised to the client’s accounting rules in their ERP – across all major ERPs like SAP, Oracle, Microsoft, and others.

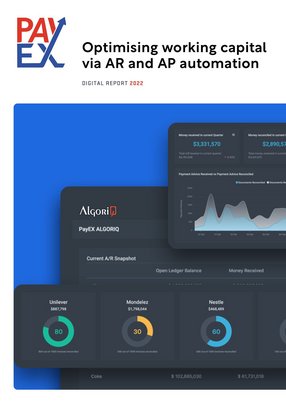

On AR, Global PayEX provides two core digital platforms – electronic invoice presentment and payment (EIPP) and reconciliation (cash application automation). On the EIPP platform, Freepay™, end customers can view invoices and credit/debit notes, make payments and deductions, view statements, and EIPP automates the accounting entries posting into the seller’s ERP. The reconciliation platform, AlgoriQ™, automates document reading such as remittance/payment advice and bank statements, and automates reconciliation and posting to the ERP (automated accounting). A key area of focus is on deductions – AlgoriQ helps to identify, tag and resolve deductions made by end customers. AlgoriQ is gaining rapid traction for ecommerce marketplace reconciliations among buyers like Amazon and Walmart.

On AP Global PayEX provides a vendor portal for suppliers and vendors to view documents like POs, goods receipt notes and payment advice. Suppliers can upload invoices via this portal. The Global PayEX platform also enables invoice process using auto-reading of invoices across formats, providing validation workflows and automating the invoice entry into the ERP.

The AR/AP platforms also enable financing workflows and automation across the anchor corporates, banks and the corporate’s buyers and suppliers. Lastly, the PayEX platforms can enable straight-through automation with all key ERP platforms.

The challenges in AR are very different to the challenges in AP, but there is still an interplay between them; after all, a vendor’s AR is a buyer’s AP.

In accounts receivable (AR), challenges faced by sellers include lost or misplaced invoices, the cost of accepting payments (specifically physical modes like cheques), resolving for part-payments or deductions, and delayed payments. A lot of time is spent by AR teams, sales teams and the end customer’s AP teams on emails and phone calls to resolve these. EIPP solves for all of these by digitising and automating the interaction between sellers and buyers.

Another key challenge in AR with institutional customers is related to deductions. Each customer could have different deduction codes to refer to the same events – whether that’s a goods return, a goods short supply or a withholding tax. Even customers in the same industry can have different terminology for the same deductions. Global PayEX’s customer (seller) may also have different terminologies in their ERP to refer to those events, for example ‘return to vendor (RTV)’ compared to ‘goods return’. Global PayEX’s reconciliation platform, AlgoriQ™, automatically reads those incoming documents and reconciles the different document formats, deduction codes and terminologies. That gives time back to the finance teams in their clients’ companies, who are no longer faced with the arduous task of having to sift through all this complex data.

In AP, the system works like a mirror-image. Vendors can upload their invoices into a vendor portal, and the Global PayEX platform is able to auto-read these invoices and to convert into a standard format. This further helps to validate and automate the processing of that invoice into the customer’s ERP.

Using data to embed financial services into Global PayEX

The end-to-end payments journey means that Global PayEX sits in the middle of a lot of data, which it can use to bring greater value for its clients. The platform can identify patterns of behaviour and learn about how customers pay their invoices, and, more importantly, when. If a customer is late with their payment, the system can obviously send reminders automatically and chase customers for money – but it is so intelligent that it is able to draw distinctions between different customers and understand when a pattern of behaviour is out of the ordinary for that company. That intelligence allows for extensive dashboarding, which can present data in a way that a company’s CFO, credit, or finance manager can interpret and action.

Global PayEX is also seeking to incorporate embedded finance into its platform. “We are trying to embed financing into these B2B workflows where we invite banks and non-banks to lend through our digital ecosystem,” Naru says. The system already knows which of a vendor’s distributors have access to financing, because it does the reconciliation for it, so Global PayEX can anonymise that data and send it to partner banks or lenders. That data allows them to make underwriting decisions and provide funding for a certain range and/or customer segment.

When a new credit line becomes available, buyers (distributors) will log into Global PayEX’s FreePay™ EIPP platform and see that they now have a credit limit of up to £50,000 or £100,000 provided by a partner institution. It’s the distributor’s decision whether to accept that credit line. If they do, they are onboarded by the institution in the usual way and, afterwards, they will see a new payment method in the app when they come to settle an invoice that allows them to pay using that credit.

“The reason banks are interested is because they want to offer a differentiated service to their corporate banking customers on the receivables/payables banking or on the corporate transaction banking side, and banks don't necessarily have these sophisticated technologies,” Naru explains. “So, they use our technology; we are the back end while the bank is the front end offering these technologies to the customer. Our latest partnership is with FIS, the payments behemoth, where they're white labelling a part of our stack globally to their customers. Several other global and regional banks leverage our platform such as JP Morgan, Standard Chartered, BNP Paribas and Deutsche Bank.”

Targeting new markets and enhancing product features

When Global PayEX was launched, it initially focused on the Indian market, where it has now established a dominant position for itself. The company is now live in the US, where it has a few big-name brand customers and a pipeline of prospects. When Naru speaks to us, he is in London conducting due diligence and laying the groundwork for a future presence there. Global PayEX wants to be live in the UK, with boots on the ground, by Q4 of this calendar year.

It marks a continued expansion for the firm, which hopes that the US and EMEA can become significant contributors to group revenues. In the next 12 months, Global PayEX will focus on growing its penetration in the US market and establishing itself both in the UK and in continental Europe. From a regulatory perspective, this provides a unique challenge: Europe has various compliance requirements to grapple with, not least GDPR.

From a product perspective, the company is working on globalisation, supporting more currencies and languages to allow for further market expansions in future. It is also looking at new requirements like e-invoicing standards and new payment mechanisms such as real-time payments, building that out from a product stack or enhancing the product stack to include them. Global PayEX will continue to invest in AI/ML technologies to improve the efficacy of its automation, giving its platform enhanced abilities to read and contextualise document formats.

Naru elaborates: “We want to get that to at least a 9/10 document auto-read capability across formats over the next 12 months, with an eventual goal being a neural network which has 99+% accuracy from day one, in terms of reading any random document related to AR and AP.”